Gold is not really a commodity, it has other merits – it is a precious metal and is increasingly seen again as real money, a reserve asset suitable for institutions and individuals.

Therefore, if we want to see what is moving the commodity index (as measured by CRB) we easily find that Oil is the heavy weighted commodity that leads the market. In fact, when we observe the charts the conclusion appears clear as water.

Only one significant doubt remains: Where do we find a short term bottom for Oil?

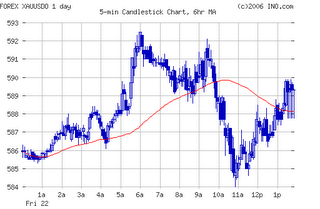

Click chart to enlarge

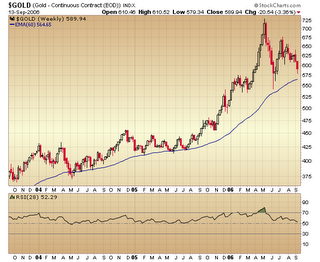

Click chart to enlargeChart courtesy of http://stockcharts.com

![[Most Recent Exchange Rate from www.kitco.com]](http://www.weblinks247.com/exrate/24hr-jpy-small.gif)

![[Most Recent Exchange Rate from www.kitco.com]](http://www.weblinks247.com/exrate/24hr-chf-small.gif)

![[Most Recent Exchange Rate from www.kitco.com]](http://www.weblinks247.com/exrate/24hr-cad-small.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/live/s_gold.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/live/s_silv.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/sp_en_6.gif)

![[Most Recent HUI from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_hui_en_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/base/copper-d.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/base/zinc-d.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/base/aluminum-d.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/base/nickel-d.gif)